The return to student loan repayment is going badly

Plus: How the endowment tax could encourage elite colleges to expand, and why increasing financial aid won't fix high college costs.

Student loan payments have been due for six months—yet no one seems to have told the students.

There’s a lot of news these days, of course. But it’s striking to me that the return to student loan repayment after an effective four-and-a-half-year moratorium hasn’t attracted more attention, both from the government and the news media. If Reddit users are to be believed, many of the 40-odd million borrowers with federal student loans aren’t even aware that payments are due again.

Borrowers who miss payments already face serious consequences, including triple-digit drops in their credit scores. If they delay further, they will become subject to collections. Taxpayers are at risk too—yawning budget deficits could widen further if student loan repayment collapses. I dove into the data in greater detail in several pieces for AEI.org.

How many borrowers are paying back their loans?

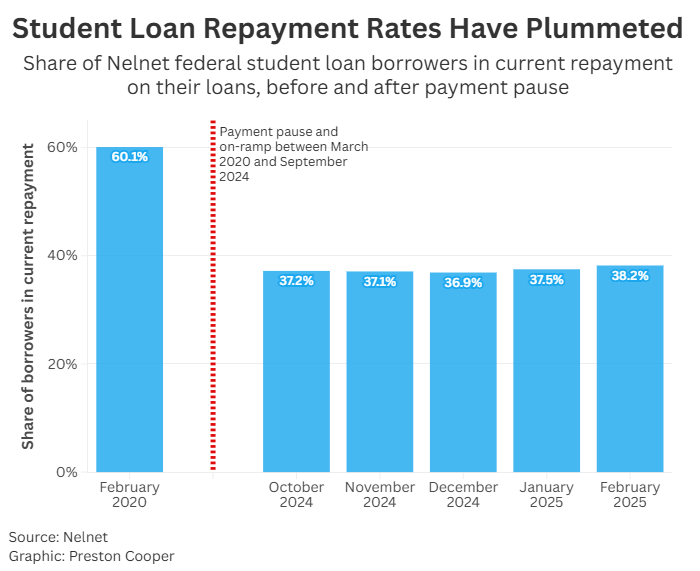

The federal government has not updated its official data on student loan repayment rates since September. However, one of the largest student loan servicers (Nelnet) provided me with data on the repayment patterns of their own borrowers. It’s bad: while 60 percent of Nelnet’s borrowers were current on their loans in February 2020, just before the pause, the current repayment rate as of February 2025 was just 38 percent.

Granted, some of this drop in repayment rates is due to the fact that millions of borrowers are in an administrative forbearance as they await the outcome of a legal challenge to the Biden administration’s new loan repayment plan. But Nelnet’s data also show a spike in delinquencies, which could translate into a wave of outright defaults as soon as this summer. Based on past trends, 3.5 million borrowers (one for every six in repayment) could default.

Researchers at the New York Fed have crunched the numbers on what this could mean. Delinquent borrowers could see their credit scores plummet by over 100 points, particularly if they had good credit to begin with. That would represent a significant shift: while most borrowers who defaulted on their debts pre-pandemic already had poor credit, there’s evidence that the current wave of delinquencies is affecting borrowers with healthy credit records, who should be able to make their payments.

That could prevent borrowers from taking out loans to buy a home or start a small business, impacting the broader economy. A wave of defaults is also bad news for the Treasury: the federal government typically only recovers 65 to 75 percent of defaulted student loan balances, and that number is likely to go down. Add lower student loan receipts to the $1.9 trillion budget deficit, and we’ve got a real fiscal mess on our hands.

What the Trump administration can do today to fix things

In a piece for the AEI blog, I explore a couple actions Education Secretary Linda McMahon could take on her own to bolster the return to repayment. McMahon could contact 40 million borrowers directly to remind them about their loan obligations—and lean on colleges to spread the same message to their recent alumni. Congress should also increase funding for student loan servicing to ensure servicers have the resources to handle the influx of borrower requests.

More fundamental, though, is restoring trust. Borrowers are frustrated with the student loan system and have little confidence that the federal government will uphold its end of the bargain. That’s a complex problem to solve. But Education Department officials should take pains to ensure that the machinery of the student loan system operates without a hitch. The agency’s image cannot afford another hit like last year’s FAFSA fiasco—let alone a breakdown in the processing of Public Service Loan Forgiveness or Income-Driven Repayment applications.

I believe history will eventually render a verdict that the student loan payment pause was a catastrophic mistake. There’s time for policymakers to clean up some of the damage. But they must act fast.

What I’m writing

Could a higher endowment tax pressure elite schools to expand? Congressional Republicans are mulling a major hike in the endowment tax, which only impacts schools with endowments greater than $500,000 per student. A higher tax could incentivize them to enroll more students and stay below that threshold—though that would be a heavier lift for some institutions.

Increasing financial aid isn’t the solution to high college costs. The average college student receives $5,300 in financial aid from sources outside their institution, which is triple the average award in 1990. Low-income students receive more than $11,000 in aid. Yet those significant investments in aid haven’t brought down net tuition, because colleges’ underlying costs have increased even further. It’s time to look beyond financial aid to solve the college cost problem.

What I’m reading

Over one-third of California community college applicants are likely fake—scammers trying to steal financial aid dollars, writes Adam Echelman for CalMatters.

Standardized test scores are still one of the best predictors of college success, even after controlling for a host of variables, concludes a new NBER working paper.

The college wage premium—once reliably rising—is now clearly falling, according to researchers at the Cleveland Fed.

Moving student loans to the Small Business Administration will come with a whole lot of operational challenges, writes Colleen Campbell for her new Substack.

Should the federal government withhold funding from Columbia University? A thoughtful debate for the Dispatch: Charles Lehman has the pro side; Keith Whittington has the anti side.

What I’m doing

Lindsey Burke of the Heritage Foundation and I are cohosting a webinar on Wednesday (April 23) about how college trustees can right the foundering ship that is higher education. Register here.

I gave a talk to a student group at Duke University last month and my visit was perfectly timed for the cherry blossom bloom on campus. Peak bloom or not, Duke is one of the most beautiful campuses I’ve seen. Fortunately, their undergraduate college has pretty good ROI.